CX Technology for Financial Institutions: Enhancing Engagement and Loyalty

Customer experience (CX) stands as the cornerstone for success in the highly competitive landscape of financial services. Most financial institutions today recognize the pivotal role of CX in both selling products and maintaining the loyalty of their customers. As such, the integration of cutting-edge technology to refine and elevate CX has become imperative for banks and other financial institutions.

The landscape of financial services is undergoing a profound transformation, driven by technological advancements and shifting consumer preferences. Gone are the days when customers solely valued the efficiency of transactions; today, they demand seamless, personalized experiences across all touchpoints. Recognizing this paradigm shift, financial institutions are increasingly investing in CX technology to deliver superior services and stay ahead in the market.

What does CX Technology mean for financial institutions?

CX encompasses absolutely any interaction customers have with a financial institution. Today, customers expect financial institutions to deliver a seamless experience, regardless of the channel through which they choose to interact. Unfortunately, many customers do not consider the experience they receive across branches, online, and mobile channels to be a seamless one.

According to the Zendesk Customer Experience Trends Report 2023:

- 72% of customers want immediate service

- 70% expect anyone they interact with to have full context

- 62% think experiences should flow naturally between both physical and digital spaces

- 62% agree that personalized recommendations are better than general ones

To make CX seamless, you need to ensure your financial institution instills CX focus in every part of your business, including the parts that are less obviously customer-facing.

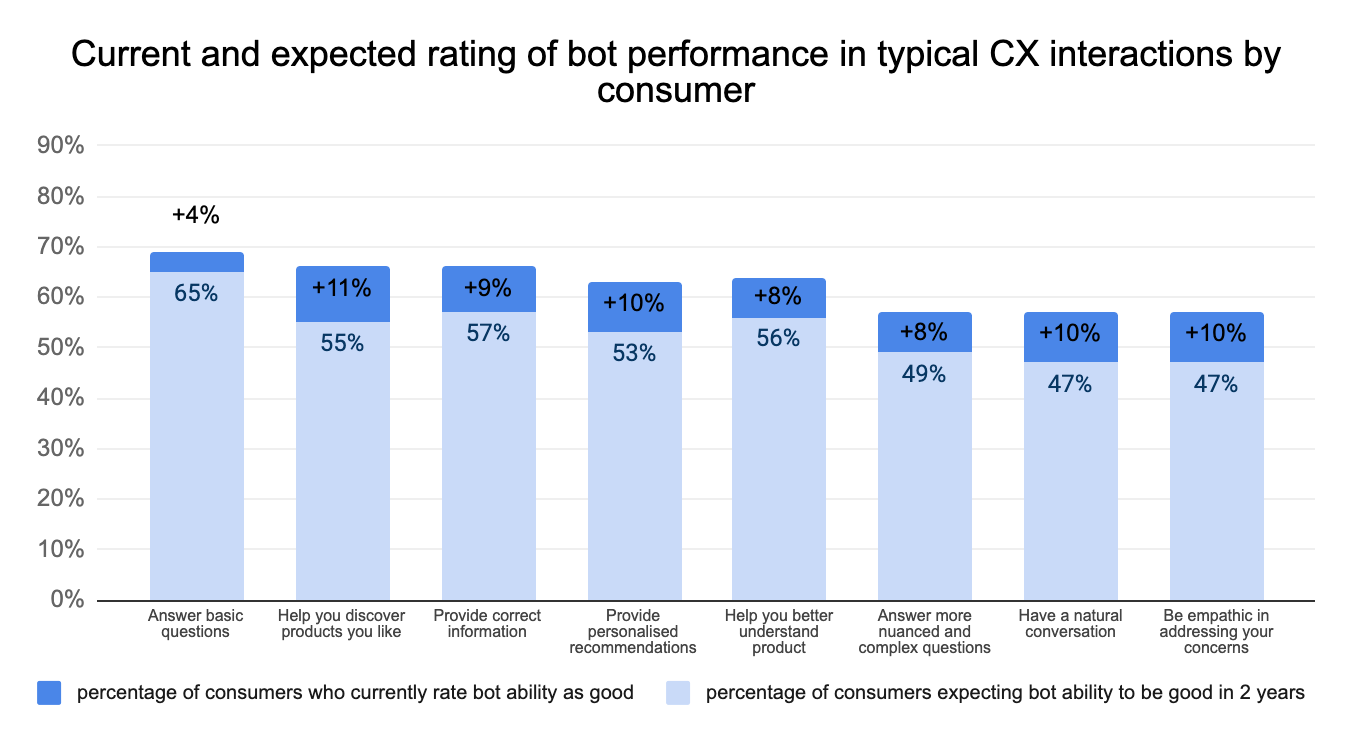

Source: Current and expected rating of bot performance by Zendesk

Let’s dive more into the technology side of the financial services customer experience. Here are some examples of CX technology in banking:

- An omnichannel customer service platform that empowers agents to deliver a seamless experience for customers, no matter where they are

- Personalized financial advice and service offerings based on individual customer data

- Digital consulting sessions that allow account advisors to review customers’ accounts with them and collaborate on-screen or in-app

Challenges of CX Technology for Financial Institutions

While the significance of CX technology is undeniable, financial institutions face several key issues in implementing and leveraging these solutions effectively:

- Data Security and Privacy: With the proliferation of digital channels, safeguarding customer data and ensuring compliance with stringent privacy regulations remain paramount concerns for financial institutions.

- Integration Challenges: Integrating disparate systems and legacy infrastructure with modern CX solutions poses significant challenges, often hindering seamless customer experiences.

- Balancing Automation with Human Touch: While automation streamlines processes and enhances efficiency, striking the right balance between automation and human interaction is crucial to delivering personalized experiences.

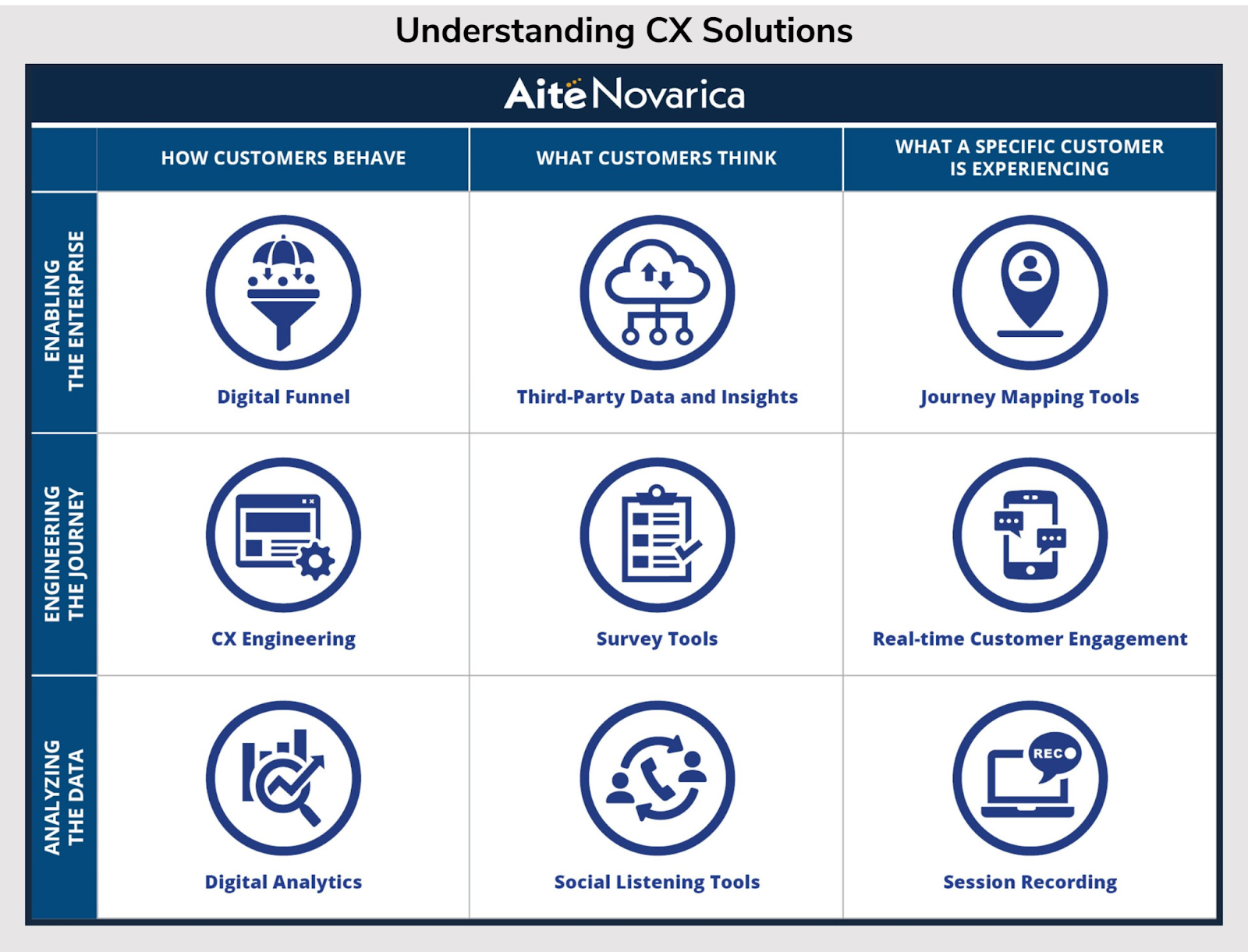

Source: Report by Datos Insights

Categories of CX Technology

AI and Intelligent Experiences

Artificial Intelligence (AI) is driving the era of intelligent experiences in financial services, empowering institutions to deliver personalized, proactive, and predictive interactions across the customer journey.

Machine learning algorithms analyze vast amounts of data to uncover patterns, trends, and insights that inform personalized recommendations and tailored experiences. For example, AI-powered recommendation engines suggest relevant products and services based on individual customer preferences, behaviors, and life events.

Predictive analytics anticipate customer needs and preferences, enabling financial institutions to anticipate future behaviors and tailor offerings accordingly. By leveraging predictive modeling techniques, financial institutions can identify high-value customers, predict churn risk, and personalize marketing campaigns to maximize ROI.

Data and Trustworthy Experiences

Financial institutions collect vast amounts of data from various sources, including transaction history, demographic information, and digital interactions. By harnessing advanced analytics and robust security protocols, institutions can analyze this data to gain valuable insights into customer behaviors, preferences, and needs. However, with great power comes great responsibility, and the key lies in using this data to deliver personalized experiences while safeguarding customer privacy and adhering to regulatory requirements.

Financial institutions must be transparent about how they collect, use, and protect customer data. Providing clear and accessible privacy policies, consent mechanisms, and opt-out options demonstrates a commitment to data privacy and empowers customers to make informed choices about their personal information.

Next Gen and immersive experiences

AR and VR technologies are poised to transform CX by offering immersive experiences, such as virtual bank branches and interactive financial simulations, enhancing customer engagement and brand differentiation.

AR-powered mobile apps enable customers to visualize their financial data in real time, providing insights into spending habits, investment portfolios, and savings goals. VR applications can simulate virtual bank branches, allowing customers to conduct transactions, attend financial workshops, and interact with advisors in a virtual environment.

Moreover, gamification techniques are being employed to make financial education more engaging and accessible. By incorporating game elements such as challenges, rewards, and leaderboards, financial institutions can incentivize positive financial behaviors and empower customers to take control of their financial well-being.

7 innovative ideas to revolutionize CX Technology in Financial Services

1. Adopt a Customer-centric approach with Personalized Self-Service & Human Touch

Even with digital transformation, a personal touch is still essential to maintaining trusted customer relationships and loyalty. The success of your CX Technology depends on your ability to support your clients when and where they need you.

Even though today’s clients prefer digital self-service functions, they still want the option to talk to a real person when they need more help. The key to delivering personalized experiences that drive satisfaction and loyalty lies in adopting a customer-centric approach, focusing on understanding customer needs, preferences, and pain points.

2. Agile and Scalable Solutions

Customers are more likely to trust financial institutions with their money when they know they can receive expert advice whenever needed. An example here could be the ability to offer customers self-service options for the answers they need, when they need them, without sacrificing the value of personal interactions.

Opt for agile and scalable CX Technology that can adapt to changing market dynamics, evolving customer expectations, and technological advancements, ensuring long-term relevance and competitiveness. An agile approach enables financial institutions to respond swiftly to customer demands and market trends, while scalability ensures that the solutions can accommodate growing customer bases and increasing transaction volumes without compromising performance or user experience.

3. Continuous Innovation

Many teams in 2023 experienced a significant surge in AI adoption, with Generative AI solutions gaining attention for innovative applications. Foster a culture of continuous innovation, encouraging experimentation with CX technology and strategies to stay ahead of the curve and differentiate from competitors.

The ‘secret sauce’ to achieving an innovative CX technology is in:

- Encouraging cross-functional collaboration and idea-sharing to drive innovation across all levels of the organization.

- Embracing Next Gen and immersive experiences such as AR and VR technologies to explore new possibilities in customer engagement and service delivery.

- Implementing feedback loops and performance metrics to evaluate the success of innovation initiatives and iterate accordingly.

4. Focus on ‘moments of truth’

Focus on critical touchpoints in the customer journey that significantly elevate the overall experience. This could be a customizable online banking dashboard to access all necessary information or an AI-driven interactive advisory for investments. Moments of truth might vary based on the customer persona, so developing a deeper understanding of different types of users is essential.

5. Map transformation of CX Technology to customer value

Identify the goals of your CX Technology and define success metrics that are linked to customer value:

Improve Digital Engagement and Retention. Improved digital CX encourages customers to engage more frequently and seamlessly with online platforms, improving convenience and revenue. Enhanced experiences also improve customer retention rates and boost repeat purchases.

Enhance Customer Loyalty. Improved CX leads to increased customer advocacy (NPS) and referrals.

Reduce Customer Complaints and Disputes. Better CX addresses customer issues promptly, reducing complaints and disputes. This improves customer satisfaction and loyalty and lowers the risk of reputation damage.

ROI. Better CX drives stronger customer relationships. This can lead to increased cross-selling (Average revenue per customer) and upselling. It also raises the average revenue generated from each customer over their lifetime (CLTV).

6. Ensure achievable and measurable CX

Approach the CX journey in manageable milestones powered by lean and iterative initiatives that can adapt to market changes quickly. Make small incremental changes to the customer experience and measure success regularly.

7. Affirm trust through transparent Digital Financial Services

Implementing stringent security measures, such as encryption, multi-factor authentication, and real-time fraud detection, helps mitigate the risk of data breaches and unauthorized access. By prioritizing data security and privacy, financial institutions can instill confidence in their customers and strengthen their reputation as trusted custodians of sensitive information.

Where’s a good place to start?

We all know the next level of personalization in CX Technology is going to come. What we don’t know yet is which areas of personalization are going to hit first, which are going to be successful, and which will not be.

Customer experience technology holds immense potential to reshape the landscape of financial services, enabling institutions to forge deeper connections with customers and drive sustainable growth. By embracing innovation, adopting a customer-centric mindset, and leveraging cutting-edge CX Technology, financial institutions can thrive in an increasingly digital and customer-centric ecosystem.

Contact Tech-Azur today to learn how we help financial institutions differentiate themselves in the market and stay ahead of competitors while meeting the evolving needs of customers.